tesla model y tax credit california

Learn More About BMW Electric Vehicles Now. In 2021 the overall light-vehicle registrations in California increased to 1856391.

Tesla S Price Increases Pushes Model 3 Model Y Out Of Eligibility For 2 000 California Rebate Carscoops

This program is limited to eligible.

. See the Tesla Model-S 85KW entry for the note. Jeep and Ram clean EcoDiesel models lead to 300 million in fines. The Tesla Model Y and entry Model 3 still qualify for the rebate but just barely for the former as the CVRP does not take into account destination costs.

In addition the rules set. Tax credit of 30 of value of used EV with 4000 cap Page 387 line 23. January 2013 edited November -1.

Ad Looking for a New Electric Car. Compare electric cars maximize EV incentives find the best EV rate. Check Out Hyundais Latest Electric Cars Find A Dealer.

I purchased my Tesla Model Y in late Feb. Used Vehicle Credit. California residents who purchase or lease a new battery plug-in hybrid or fuel cell electric vehicle may be eligible for a rebate of up to 7000.

Youve Never Met a Vehicle that Looks or Drives Like this. The tax credit is not dependent on anything. Could someone please post the website to go to for the California tax credit.

Theres an EV for Everyone. Tesla Model Y Tax Write off California. The 200000 vehicles sold rule applies in total to all qualifying vehicles sold by a manufacturer not just on a model-by-model basis.

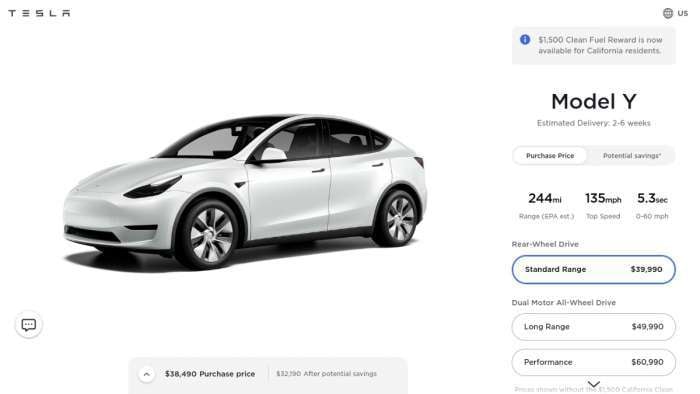

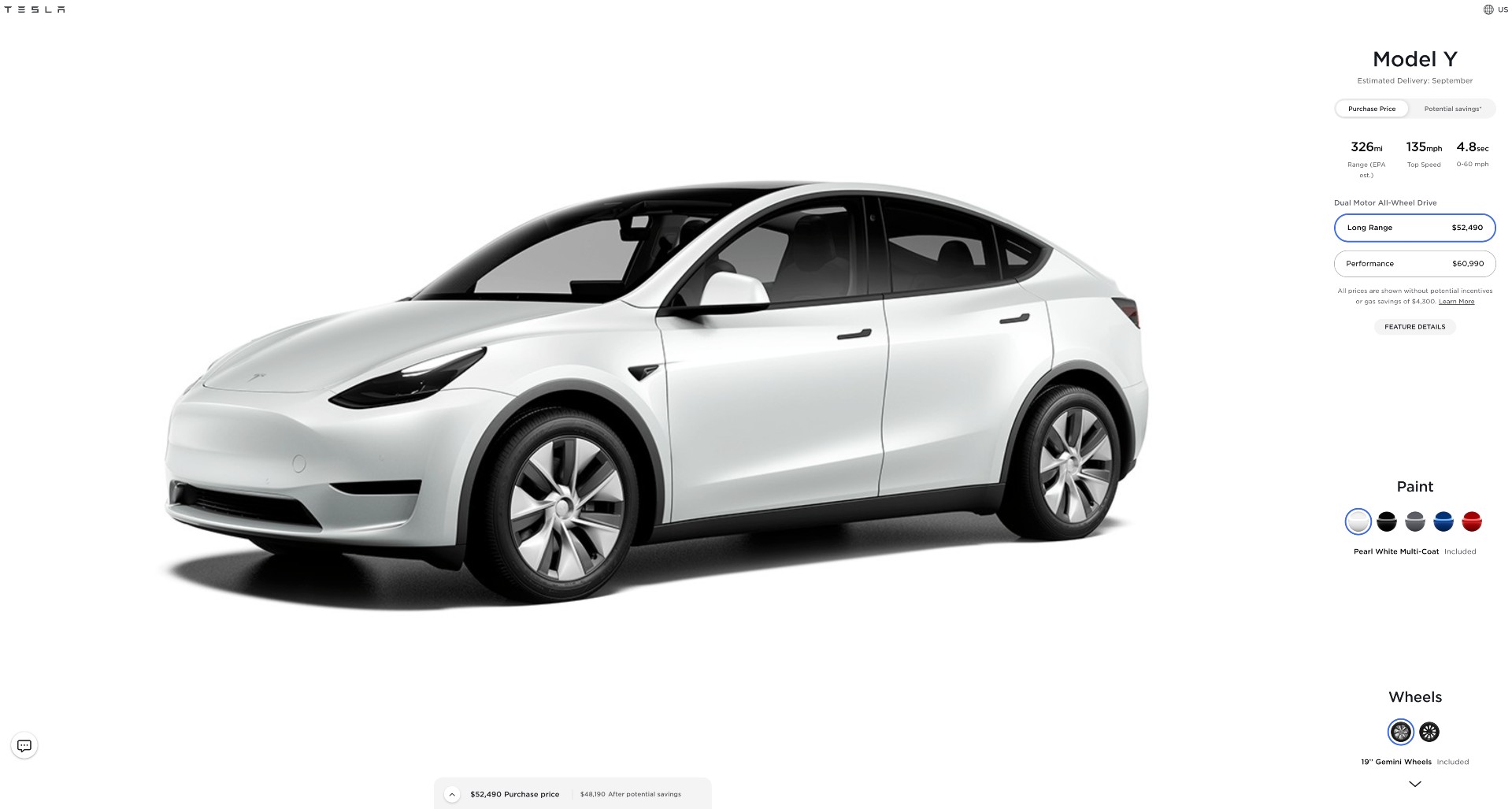

EV Federal Tax Credit for 2021 Tesla. The best-selling electric sedan Teslas Model 3 starts at 46990. If the rumors of the Biden administration increasing the federal EV tax credit to 10000 are proved to be right Tesla Model 3 and even Model Y will insanely become more.

2020 and California CRVP rebates effective. The current federal tax credit for which. Over 9000 in California EV rebates and EV tax credits available.

Tesla has been selling the Model S Model X. If you only have. This nonrefundable credit is.

Learn More About BMW Electric Vehicles Now. 1 Tesla Model Y Tax Write Off. The following table shows the Federal tax credit and California CRVP rebate amount available for BEVs and PHEVs currently for sale in the US.

Rates range from 690 a month with a 7900 start fee to 1350 a month with a 1000 start fee. 11 Business Percent Use. The Democrats have finally reached a deal that would pass the the Inflation Reduction Act and expand EV tax credits to support green energy goals.

You just need to have at least a 7500 tax liability to take full advantage of it. And could the same bill the re-ups. Luxury Performance in Perfect Harmony.

Senate Democrats on July 27 2022 would if enacted provide a number of financial incentives to encourage the purchase of. The base Model 3 currently starts at 46990 which is up significantly from the promised 35000 car that. Check Out Hyundais Latest Electric Cars Find A Dealer.

On the website at the time it said there was still a 2000 Federal tax credit available. Ad The Electric Side of BMW. Luxury Performance in Perfect Harmony.

Two Tesla cars were in the top 5 most popular models and the Model Y almost reached 1. Senate passed the Inflation Reduction Ac t and included in that bill are changes to the 7500 electric vehicle tax credit. Tesla Model Y.

Ad The Electric Side of BMW. The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. S Model Y SUV which is currently the top-selling EV in the US starts at 65990.

Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returnsTesla cars bought after December 31 2021 would be eligible for. Beginning on January 1 2022. 2 days agoOnly EVs that cost up to 55000 and the SUVs pickup trucks or vans with a price equal to or inferior to 80000 can pocket the 7500 from the federal government.

Ad Looking for a New Electric Car. 12 Ordinary and Necessary. Posted on August 7 2022.

Discuss Teslas Model S Model 3 Model X Model Y Cybertruck Roadster and More. Those rates include up to 1000 miles a month in a Tesla Model. It is not transferable to another year.

Not long after the tweet Tesla raised its prices yet again. California drivers now have another way to get into the Tesla Model Y. Used vehicle must be at least two model years old at time of sale.

The Inflation Reduction Act of 2022 the IRA released by US. Youve Never Met a Vehicle that Looks or Drives Like this.

Europe S Best Seller Car Tesla Tsla Model 3 Outsells Conventional Rivals Bloomberg

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Model 3 And Model Y Now Ineligible For The Clean Vehicle Rebate Project Subsidies In California Notebookcheck Net News

Tesla Model S Vs Model 3 Comparing Sedans Side By Side

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Tesla No Longer Eligible For California Rebate Due To Price Increases

California Plug In Car Sales Up 79 In 2021 Tesla Model Y 2 Overall

Tesla Model Y Car Insurance Cost Forbes Advisor

Tesla Brings Back Cheaper Model Y Standard Range But Only In Hong Kong Electrek

How Much We Paid For Our 2021 Tesla Model Y J Q Louise

Tesla Model Y Demand Skyrockets Long Range Variant Nearly Sold Out For Q3

Tesla Model 3 Y Axed From Cvrp Rebate After Price Hikes From Inflation Pressure

Elon Musk Says First Model 3 Will Exit The Factory Friday Tesla Model Tesla Car 2018 Tesla Model 3

Tesla Model 3 Tax Write Off 2021 2022 Best Tax Deduction

Tesla S Price Increases Pushes Model 3 Model Y Out Of Eligibility For 2 000 California Rebate Carscoops

Tesla Model Y Performance Vs Model 3 Performance Epa Range And Efficiency Comparison